In this interview at the eTail West 2017 conference in Palm Springs I met with Greg Lisiewski CEO of Blispay, a company making in-store financing easy for shoppers and retailers.

It's a well known fact that offering financing helps improve the Browser-to-Buyer conversion online. Financing is also a major factor in the store and where there are currently many friction points for both shoppers and retailer staff as they go thru financing applications. One of the challenges for retailers has been the costs and effort involved in implementing and offering financing to shoppers in their stores, practically limiting financing to the largest of retailers.

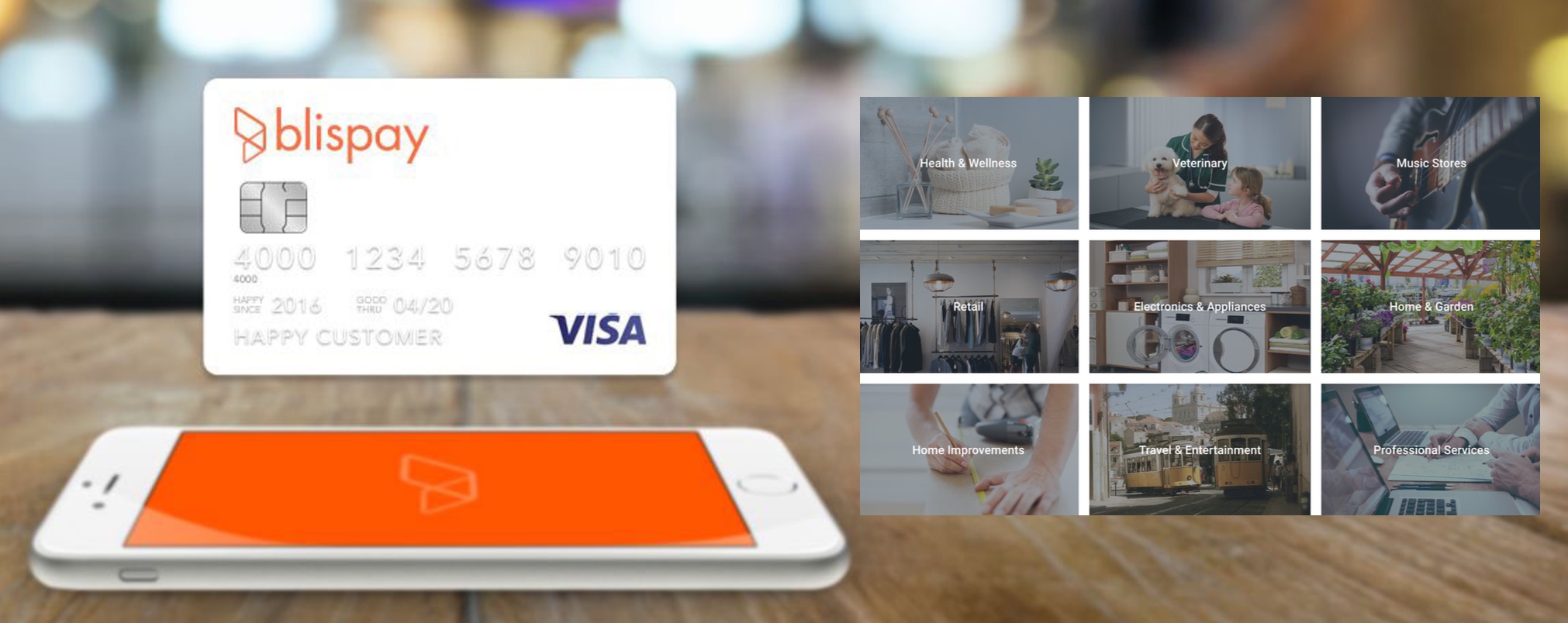

I have interviewed other retail financing businesses in the past and was interested to learn how Blispay is innovating in the space. Blispay makes financing easy and accessible and businesses of any size can offer financing to shoppers with no integration or incremental costs outside of already existing credit card fees if they already offer Visa.

Blispay's business focuses on removing the friction around the in-store financing cycle and make it easier for shoppers and retailers to take advantage of financing resulting in a win-win for both. This is specially important for small businesses, because they do not have the means to set up a program, lend the funds, take on the additional risk and comply with consumer credit laws.

As founder and CEO of Blispay, Greg Lisiewski is no newcommer to the payments and financing business. He was previously PayPal’s Head of Global Credit Products and held various operating and leadership roles during his ten years at consumer credit pioneer MBNA, and then eight years at Bill Me Later, which was acquired by PayPal for about $1 billion.

Greg has been an innovator in consumer credit for more than 20 years, and has led Blispay to a $12.75M seed funding in March 2016.

Listen to this interview as I go thru the different nuances in the in-store financing business with Greg and how he is helping resolve some of the key blocks with Blispay, how he started the company and the simple ease of setting up the integration with the store.

I specially love the last point, which is becoming a more common theme specially among the newer services offered to retailers, the ease of integration.

And please feel free to share the interview with friends and subscribe to our newsletter.