Shoppable Livestreaming Market Analysis

Livestream shopping (aka shoppable livestreaming, live-video commerce, live commerce, liveshopping and more) is a new way to shop by purchasing products, or services inside a real time livestreaming video session where both sides, the seller and shopper, are present at that moment and communicating with each other interactively either via full audio or in-app messaging.

Although the concept is referred to in different terms such as live shopping, live video shopping, livestream shopping and more the common differentiating experience is the interactive live stream video merged into a shopping experience including shopping cart, payment, shipping and other e-commerce features.

The key benefit of a fully shoppable livestream is that “your customers never have to leave the app” to make purchases and the personal engagement results in higher AOV (Average Order Value) and Conversion.

LIVESTREAM SHOPPING IS DIFFERENT FROM VIDEO SHOPPING (see report 2 here)

An important point is that “shoppable live streaming” is different from “shoppable video”. Shoppable video is typically the ability to buy specific items in a pre-recorded video and there are several players in the space.

On the other side of the industry the more expansive modes of Live experiences are creeping into virtually every aspect of consumer experiences and business with what has been called “Nexgen Live” which goes beyond the transactional commerce side and into gaming, entertainment, travel, music, the metaverse (AR/VR) and more.

HISTORY OF SHOPPABLE LIVESTREAMING

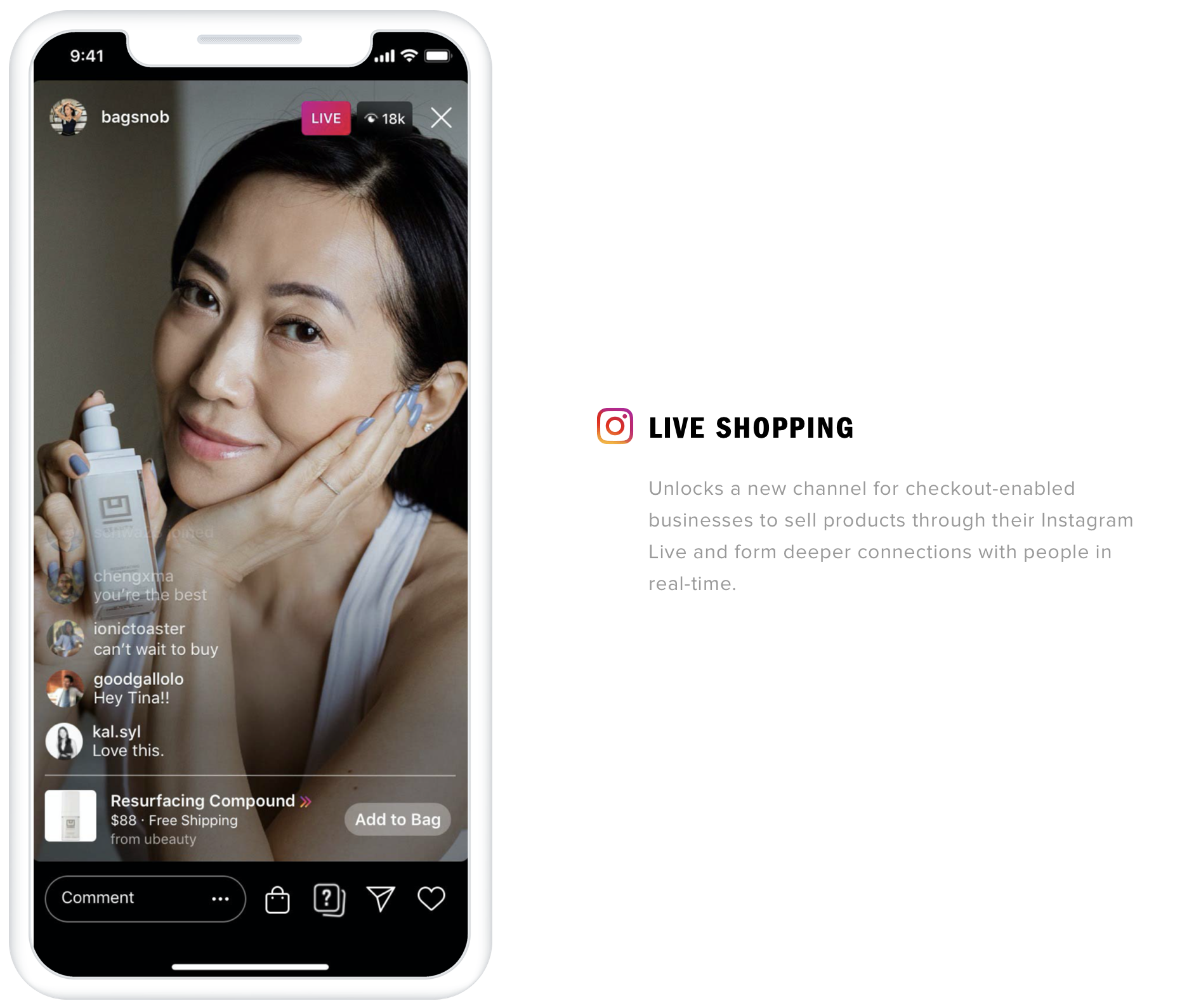

Shoppable livestreams are gaining traction due in large part to the explosive growth of live video. Virtually all the major social apps are offering some form of live video, and as consumers are utilizing this feature more, the app companies are increasing investment and innovation into the space.

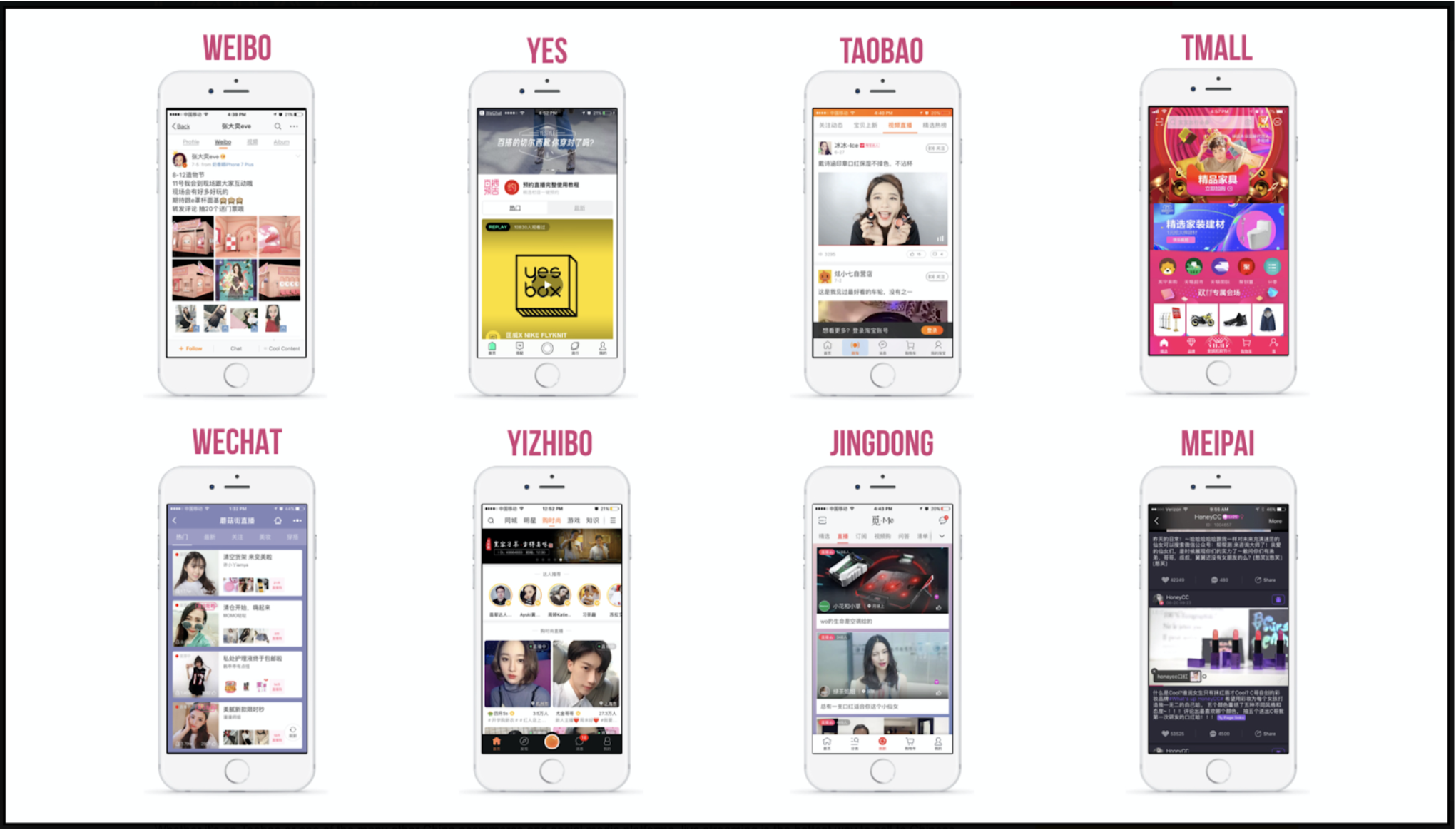

There is also the element of the “super app” which is already underway in china with Taobao and is an eventual, possible, outcome in the future as only a handful of very large apps will be where most of the people on the planet will be spending their time on. Shopping and commerce is a massive industry and it’s only natural for both consumers and brands / retailers to want to do business in the same experience.

Although startups were working on the live shopping concept since the 90’s real consumer traction and transaction volume began starting in the mid 2010’s in China by the Daiguo cross-border shopping concept where shopping agents in the US used apps like WeChat to shop for their clients in China.

The practice only gained ground by increased demand from high end fashion forward Chinese consumers and the additional posers of live streaming and morphed into what we today call Shoppable livestreaming. The sheer amount of sales in China has really taken off in China and the growth has only intensified since the Pandemic, practically pulling 2023 projections 3 years forward and projections for 2020 are at $123 Billion in China with compelling reasons why livestream shopping is catching on with consumers.

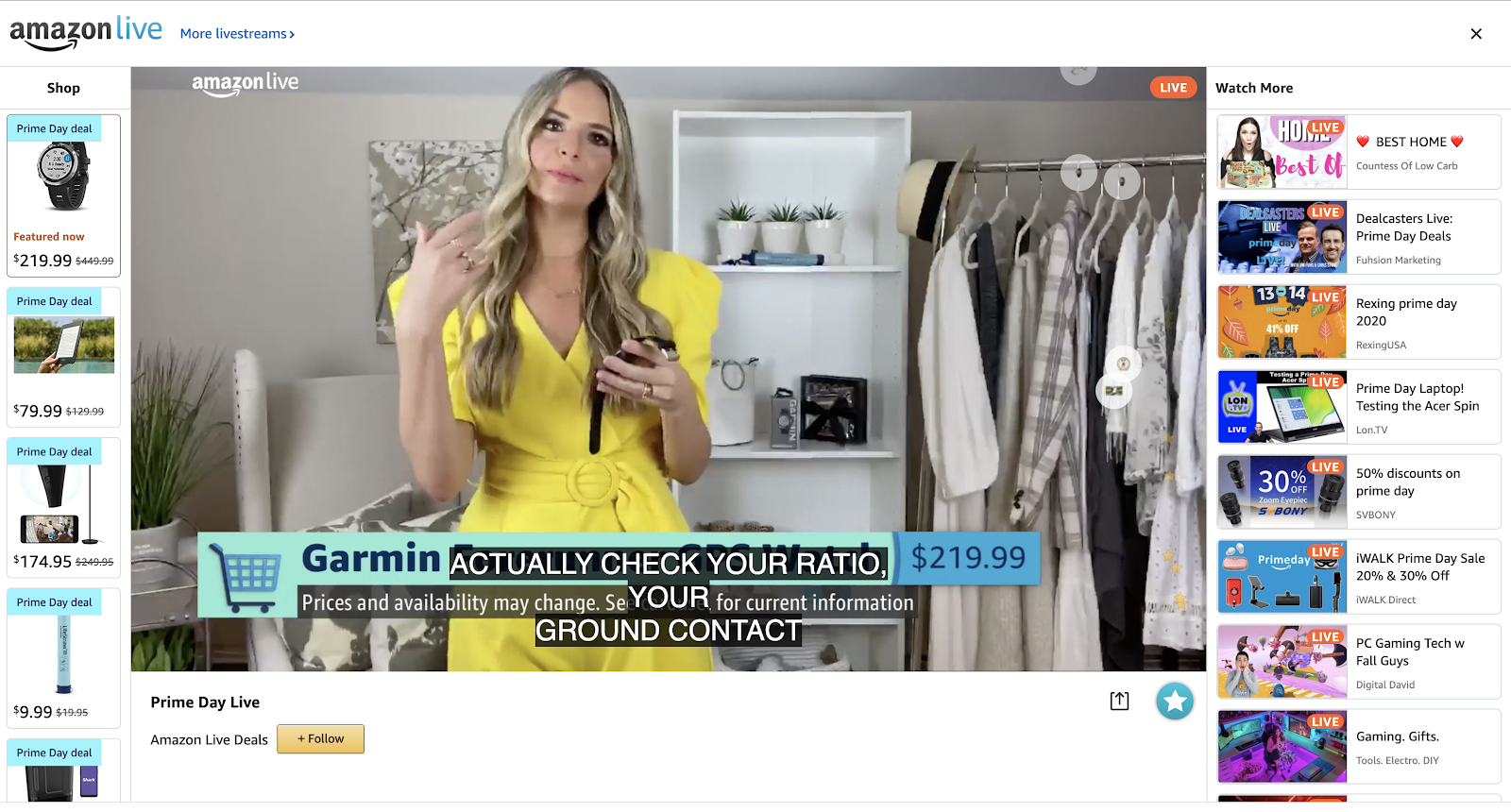

Livestream shopping in China has been compared to the next evolution of QVC and many US players are following the same experience as we discuss below. ‘Kim Kardashian sold 150,000 bottles of her KKW perfume in just a few minutes when it was featured on top live streamer Viya’s show last year on Tmall, the main rival to Taobao Live. An incredible 13 million viewers watched the event.

In the US there were concepts around live shopping as early as the first dot com boom with startups including LiveShops, but the effort did not take off due to multiple factors including infrastructure, lack of interest from customers and mostly a lack of a genuine "need" from the US consumers since they had ample and easy access to any product they wanted within reach of a few minutes drive to the mall. The US market is turning now and there are multiple companies, including the largest ecommerce and technology players, joining the livestream commerce space and the COVID-19 Pandemic has accelerated the growth and usage of livestream shopping by consumers.

Coresight Research predicts live-stream shopping events in the U.S. will generate $25 billion in sales by 2023. The streamed events are already a big business in China. A Tommy Hilfiger live-stream show in China in August attracted 14 million viewers and sold out of 1,300 hoodies in two minutes.

Brands are also experimenting with livestream commerce including Levis, Hilfiger, Cadillac and Pomelo among many others.

SHOPPABLE LIVESTREAM USER EXPERIENCE MODELS

Overall there seem to be three different experience models used in the shoppable livestream space:

1. The Instagram/Snapchat mobile app model with one-many shopping and on-screen faves, messages and reactions.

2. The QVC style web (mainly) experience with full page with, almost TV like CX one-many sessions and combines messaging and some voice.

3. The private one-one app experience for VIP style livestream shopping experiences.

CURATION

A large differentiator in how the companies present products to shoppers is the differentiation between curated products or open commerce. Starting with QVC and HSN and extending to the majority of other companies doing the same model curation is a common factor where the company selects and produces the sales session based on what they want to sell. In contrast the more open models allow individual sellers such as brands, influencers, retailers and even individual shopping agents select their own products and use a marketplace approach to help consumers discover and shop for what they are looking for (or happen to find).

THE PLAYERS

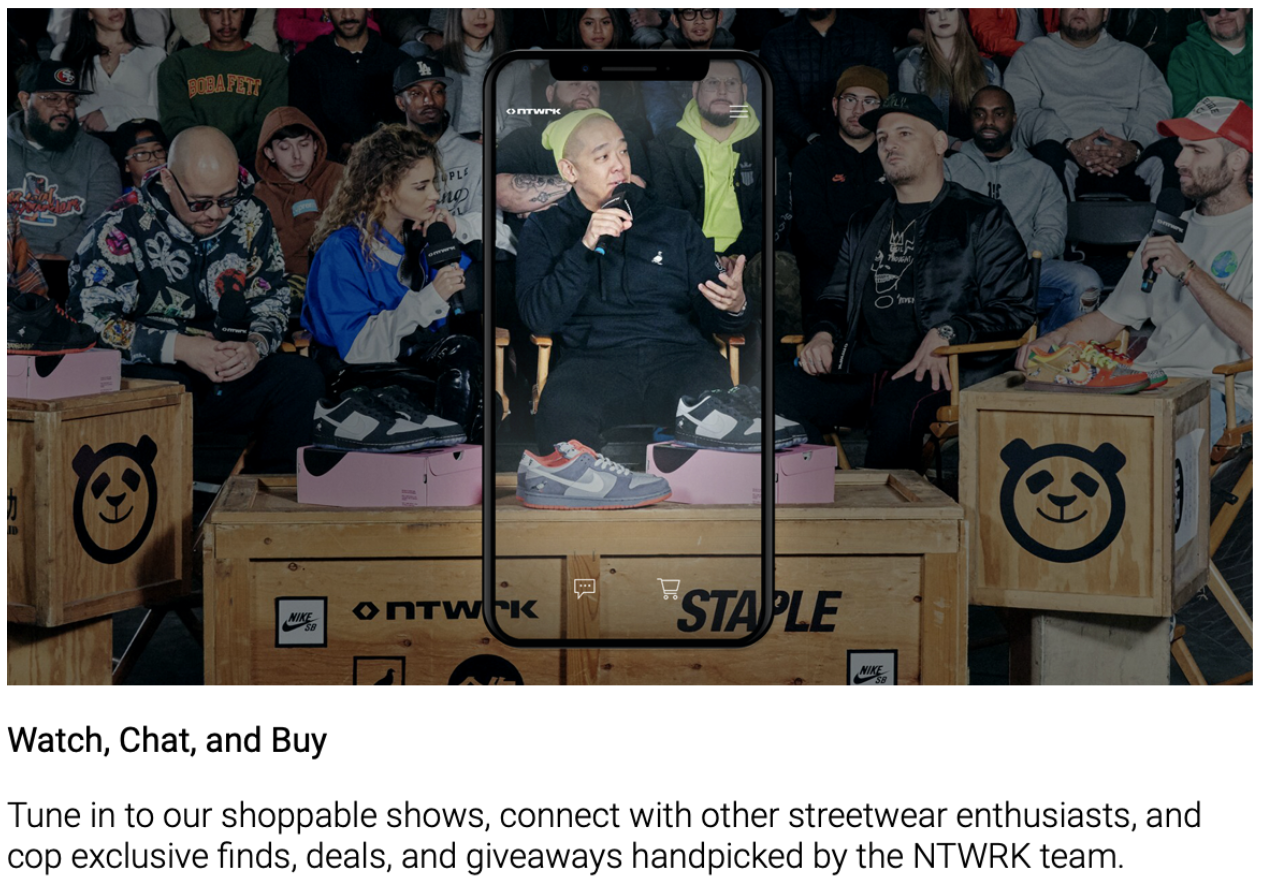

In this report we’ll look at the current players in the space (alphabetical list) with a heavier focus on the US and the opportunities for investors and brands to get a head start on a coming tsunami of a new way of shopping, a hybrid of catalog based ecommerce, in-store shopping and real time livestream video.

Note: this is not an exhaustive list of all the companies. Members of our Premium research receive the comprehensive report and additional analysis and insights plus other benefits.