Chat Commerce and Concirege Research Brief

Over the last decade, dozens of startups have promised to revolutionize commerce by using chat as the primary interface. The pitch was simple and seductive: instead of browsing cluttered websites or downloading new apps, consumers could simply text what they wanted and get it delivered. By placing commerce into a familiar channel like SMS, WhatsApp, or Messenger, startups hoped to make shopping and concierge services as easy as sending a message to a friend.

But while the idea has recurred in cycles since 2015, nearly all early attempts failed. They struggled with poor unit economics, messy user experiences, and scalability challenges. Today, with the rise of AI and a growing emphasis on resale and sustainability, the sector is reemerging with new players and renewed movement in both new and resale categories.

This brief reviews the history, current experiments, and lessons learned in chat-based commerce, and outlines where the model may yet succeed.

The Promise of Chat-Based Commerce

Chat offers three big advantages as a commerce channel:

Zero-friction entry: Everyone knows how to send a text, and nearly everyone checks their messages daily. Asking a customer to text “sell this chair” is far easier than onboarding them into a new app.

Human-like interaction: Chat simulates a conversation with a concierge or personal assistant. For high-value or stressful purchases, this feels reassuring compared to self-service browsing.

Notifications and nudges: Because messages land directly in the personal inbox, they have higher open rates than emails or app notifications.

In theory, chat could bridge the gap between traditional e-commerce (structured, but impersonal) and full-service concierge (personal, but expensive).

Historical Attempts and Why They Failed

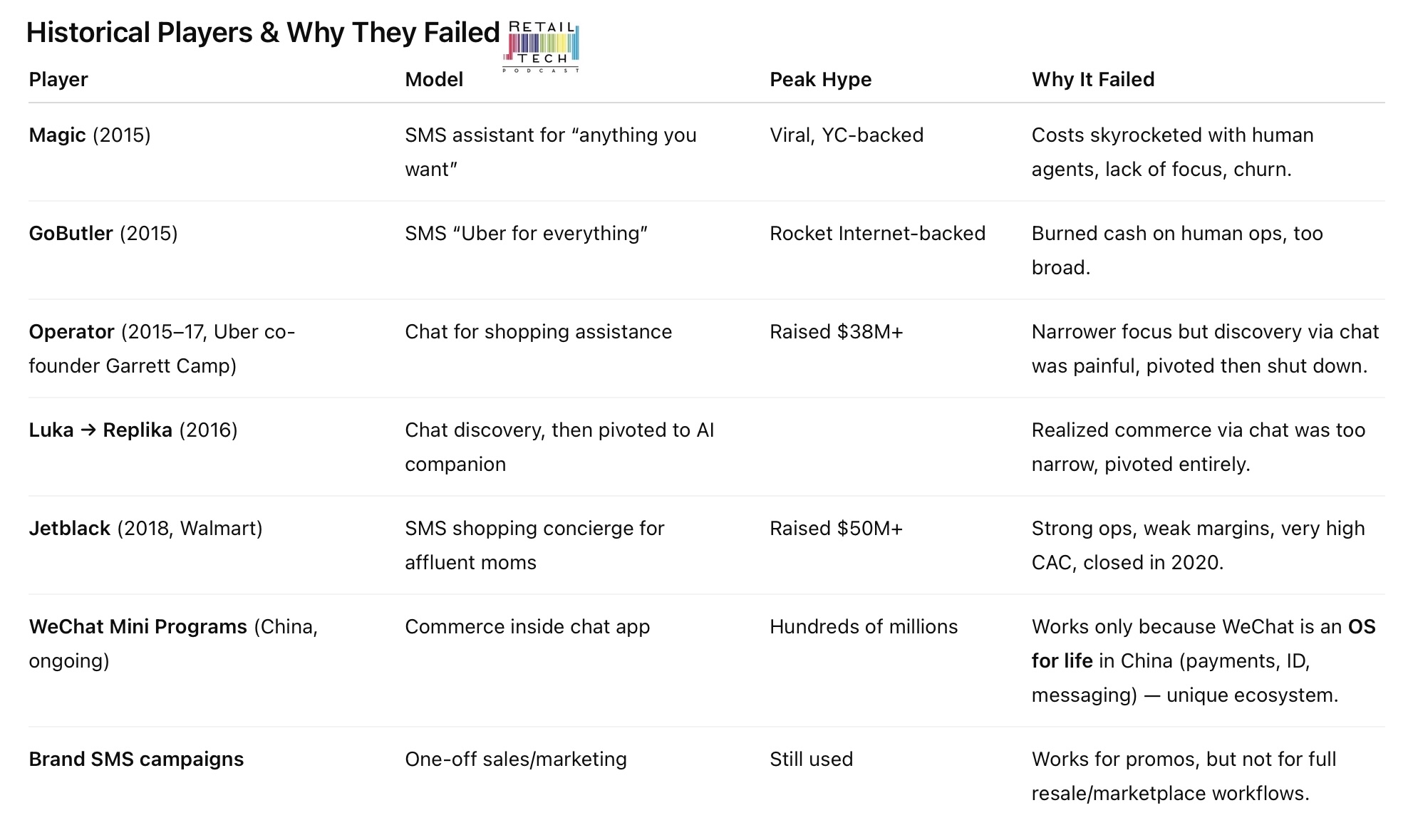

Several high-profile startups pioneered this space:

Magic (2015): A viral Y Combinator-backed service that promised to fulfill any request via SMS. The novelty attracted headlines but unit economics collapsed—behind the scenes, humans were doing the bulk of the work. Costs ballooned and churn was high.

GoButler (2015): Backed by Rocket Internet, GoButler attempted to be the “Uber for everything” via SMS. Like Magic, it burned cash on human operations and shut down within a year.

Operator (2015–2017): Founded by Uber’s Garrett Camp, Operator narrowed the scope to shopping assistance. Despite raising over $30 million, it struggled to scale. Discovery and browsing through linear chat proved clumsy, and users preferred platforms with richer interfaces.

Jetblack (2018–2020): Walmart’s bet on SMS shopping targeted affluent mothers. With dedicated human concierges, Jetblack offered premium service but at enormous cost. Despite raising $50M, retention was weak, CAC was high, and margins unsustainable.

Luka (2016): A chatbot-driven discovery app. The founders quickly realized commerce via chat was too limited, pivoting into the AI companion platform Replika.

The common themes of failure were:

♦ Overly broad promises (“anything you want”) that required human labor.

♦ High operational costs with no path to automation.

♦ Poor user experience: a linear chat thread is ill-suited to managing multiple items, offers, or logistics.

♦ Lack of strong network effects to lock in users.

One important counterexample exists: WeChat Mini Programs in China. Within WeChat, chat-based discovery and transactions thrive—but only because WeChat acts as an entire operating system for life, integrating payments, identity, messaging, and commerce. In Western markets, no chat app holds that level of ecosystem dominance.

The Current Wave

Despite the failures of the last decade, a new set of players is emerging, betting that AI will change the game.

WhatsApp Commerce Pilots

In India, Brazil, and other regions, WhatsApp is becoming a commerce channel. Businesses use WhatsApp Business APIs to sell directly. While this has traction in emerging markets, it tends to work best for simple, single-purchase workflows, not complex resale management.

Luxury & Niche Resale Concierges

A growing number of micro-concierge businesses run resale via SMS or Instagram DM, especially in high-value categories (sneakers, handbags, furniture). These remain boutique operations, heavily human-reliant.

AI Concierge Startups

Companies like Lindy.ai, Sierra.ai, and device-makers like Rabbit have all pushed AI-driven chat or voice assistants as commerce gateways. None has cracked broad adoption yet, but they illustrate the continuing pull of this idea.

Rid (rid.me)

Focus: resale concierge. Sellers text or upload a photo of an item, and Rid handles everything—pricing, listing, negotiation, pickup, and delivery.

Why Chat Alone Is Not Enough

The core limitation of chat as a medium is organization.

Commerce involves multiple threads: items, offers, buyers, shipping updates, payments, disputes. In a chat thread, all these collapse into a single linear conversation. One seller with ten items to offload suddenly faces a confusing scroll of mixed updates.

This is why Jetblack customers grew frustrated, why Operator churned users, and why Magic’s novelty wore off. Chat is excellent for intake and quick nudges, but terrible for multi-item state management.

Another barrier is privacy. Many users dislike mixing personal SMS inboxes with resale transactions. While WhatsApp succeeds in some markets, in the U.S. and Europe consumers are wary of business use in personal chat apps.

Lessons Learned

Use Chat as a Wedge, Not the Destination

Chat works beautifully as a low-friction entry point: “text us a photo of what you want to sell.”

But structured dashboards or apps are needed to organize listings, offers, and sales.

Narrow the Scope

“Anything concierge” models fail. Narrow categories—like Rid’s focus on resale—are more automatable.

AI Reduces Costs, But Logistics Still Hurt

AI can replace much of the pricing, listing, and negotiation work that humans once did.

However, physical logistics—pickup, authentication, delivery—remain expensive and local.

Target the Right Segments

Works better for:

High-value resale (luxury goods, furniture, electronics).

Dense urban areas where logistics are more efficient.

B2B resale contexts (bulk electronics, office equipment).

Design for Trust and Privacy

Users should be able to opt for web/app experiences once trust is built.

Mixing resale with personal inboxes long-term is unlikely to scale.

Future Outlook

The chat-commerce sector will not produce a winner if companies insist on chat-only products. History has proven this model unworkable.

The winning playbook will look like this:

Phase 1 (Chat): Use chat for frictionless onboarding, where consumers simply text a photo or request.

Phase 2 (Hybrid): Transition users to a structured app or web dashboard for managing multiple items and offers. Chat remains for notifications and quick actions.

Phase 3 (Ecosystem): Build a full marketplace with browsing, discovery, and community, while keeping chat as the lightweight funnel entry.

But the cautionary tales of Magic, Operator, and Jetblack loom large. Chat is not the future of commerce in itself. It is a useful wedge—a front door to onboard customers into richer, more organized systems.

Conclusion

Chat-based commerce has been a graveyard of overhyped startups, but the idea refuses to die. The emergence of AI-powered players like Rid suggests that, with narrower focus and smarter automation, there may be life in the model yet. The lesson from the last decade is clear: chat can open the door, but it cannot be the house.

Copyright 2025 Retail Tech Podcast. All Rights Reserved.